Getting a personal loan in the Philippines can often feel like trying to make your dinner blindfolded. You’re never sure if you’ve got the right ingredients, and if you get it wrong, you’re going to get thrown out of the kitchen. Or, in this case, the bank.

Having instant cash when you need it most can be a lifesaver. Whether it’s to pay for an essential repair to your home or car, to fund some medical care not covered by insurance, or simply to give your child the opportunity of the best education possible, personal loans are there to help you get ahead in life.

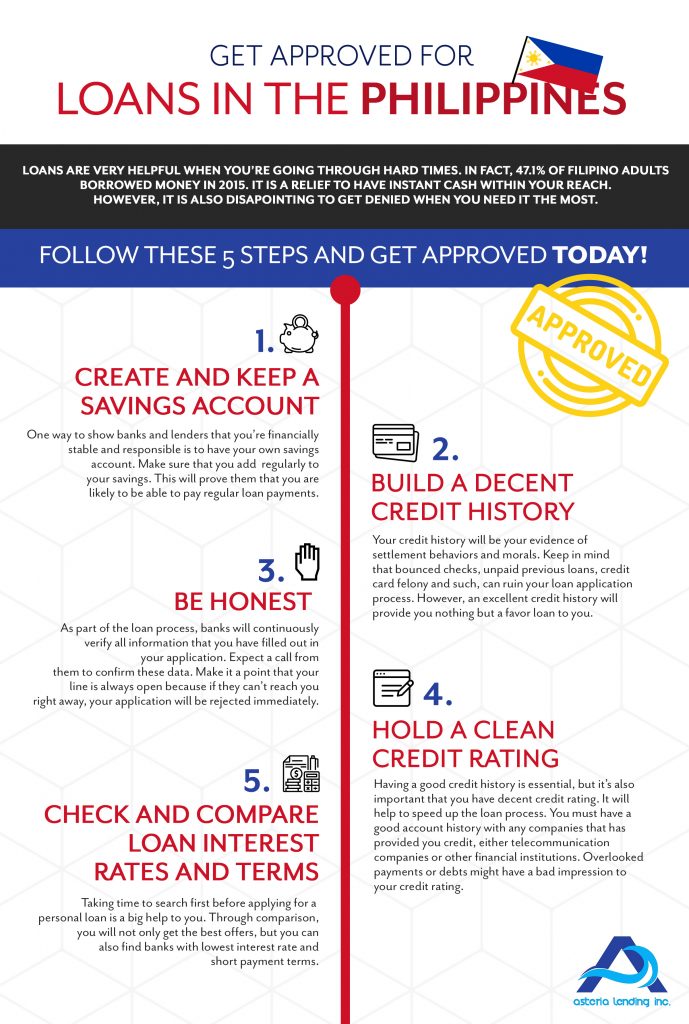

Almost half of Filipino adults take out a personal loan each year, helping them out when times are hard or unexpected expenses crop up. However, when you get turned down for a loan, it can feel like a kick in the teeth when you’re already worried about financing your needs.

Here, we’re going to give you a list of all the ingredients you need to give your loan application the best chance of success. Take off your blindfold, because we’re going to show you how to cook up the perfect recipe to secure your personal loan so that you have a better chance of getting the ‘yes’ that you need.